Written By Aditya Sharma:

The recent market downturn has illustrated the impact oil price changes can have on equity markets. Crude has been trending lower since late 2014, so much so that many major oil producing countries are selling it at a loss. Using the conversations on the StockTwits Platform and SMA’s patented sentiment calculation technology we have identified an interesting connection between sentiment and subsequent changes in the front month Crude contracts over the last year.

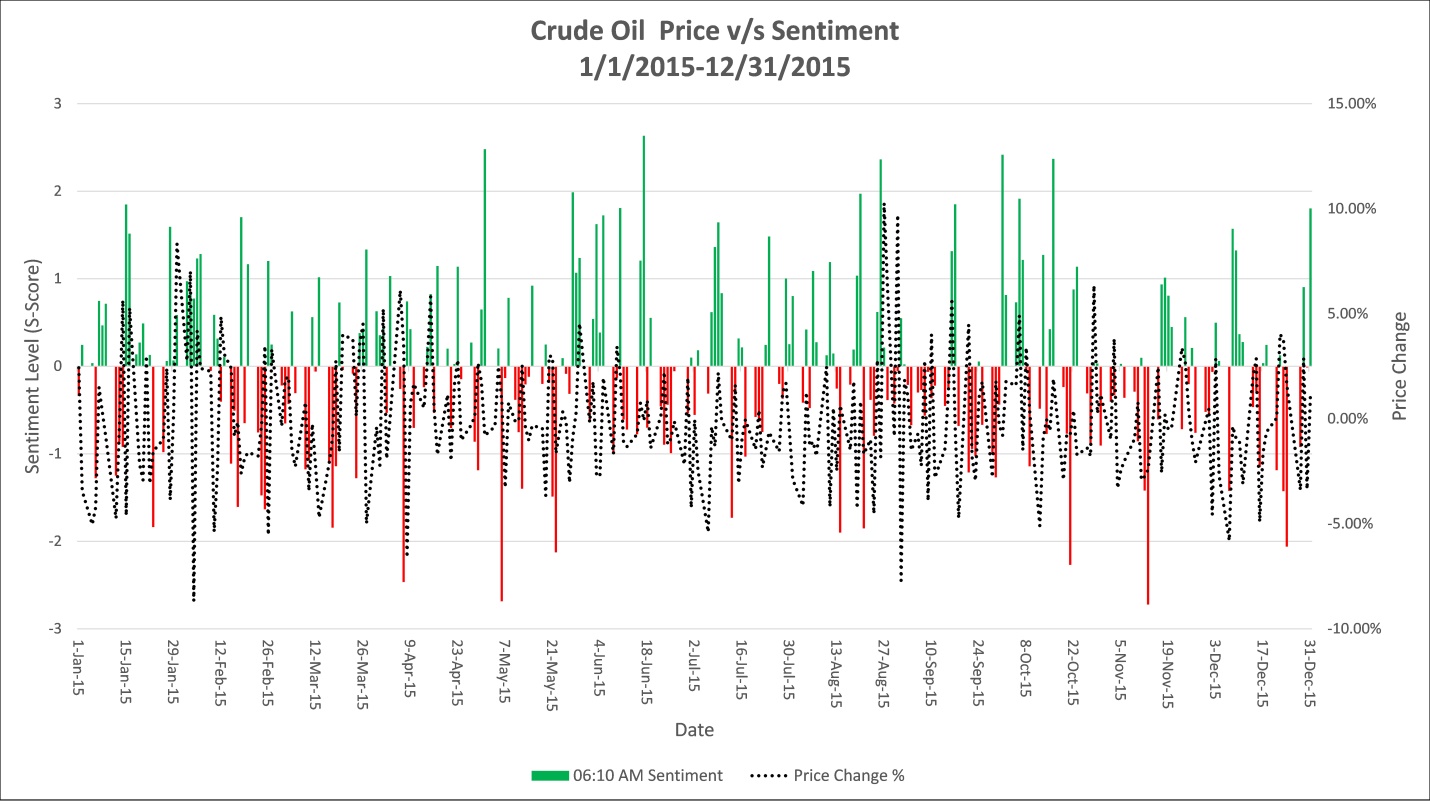

The chart below demonstrates the daily price changes in the Crude Oil prices ($/barrel) overlaid with the sentiment levels as computed by SMA metrics before the US market opened (6:10 AM Eastern). The sample period was all of 2015

If Crude sentiment is positive at 6:10am Eastern Time, 79.02% of the time, the price of front month crude contracts will trade higher than the prior days close over the next two days. If sentiment is negative Crude will trade lower than the prior days close at some point over the next two days.

Thus, using StockTwits based SMA sentiment in your crude trading decision process can provide you with a meaningful directional edge!