We are often asked about broad market indicators for different asset classes. Recently Koby finished some research on a Crypto Currency broad market indicator that is predictive of future Bitcoin prices. We call this indicator the Crypto Market Score (CMS).

For the CMS we take once a day snapshots of all coins with a sentiment value. Our universe of covered coins consists of coins that have at one point been in the top 200 market cap of all cryptocurrencies. Our universe currently stands at approximately 600 coins. We use our patented NLP to read and assign sentiment scores to each Tweet. Each Tweet is scored from -1 to 1 out to four decimal places. Because each Tweet is scored independently, we are creating a Tweet count weighted sentiment value. We aggregate the sentiment from all coins over the last 24 hours by date to aggregate to a daily sentiment value.

We calculate a 14-day rolling sum of the sentiment values and compare it to a 60-day baseline to generate a CMS. Our CMS is a Z-Score with a 14-day summation of Tweet scores for all coins in our universe and compared to a 60-day baseline.

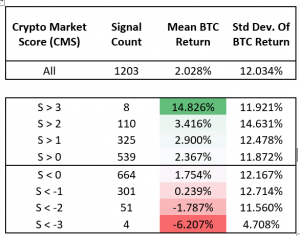

We compared the CMS to forward weekly bitcoin returns. There are a total of 1203 days of data with the CMS ranging from -4.00 to +4.00. In the table below Positive (539) + Negative (664) = our test period 1203 days.

Below are the general return characteristics on the Crypto Market Score. The average 7-day return for BTC was 2.028% for our test period.

As you can see from the return table, days the CMS is positive Bitcoin returns 2.367% over the next 7-days. When the CMS is negative, Bitcoin returns 1.754% over the next 7-days. As the CMS rises the subsequent return of Bitcoin increases; reaching a high of 14.826% for the 8 instances when our CMS is greater than 3. When the CMS is negative, Bitcoin 7-day returns are less than average or in some cases negative. These relationship between the CMS and forward 7-day Bitcoin returns is a positive linear relationship as shown by the monotonic nature of the return characteristics. To learn more about our Market Sentiment Score or Social Market Analytics ContacUS@SocialMarketAnalytics.com.