Social Market Analytics, Inc. (SMA) has partnered with S&P Global Market Intelligence on ‘Machine Readable Filings’ (MRF). Machine Readable Filings is the first product to provide parsed textual data of SEC Edgar Regulatory Filings at the Item, Section, Sub-section, and Notes level with historical baselines back to 2006, along with sentiment values provided by SMA’s patented Natural Language Processing (NLP) technology. Extraneous information such as page numbers, images, and tables are removed. SMA is currently developing the same structured data with sentiment values on International Regulatory Filing Reports which will be released in Q4 2020.

SEC regulatory filings are formal documents reported to the U.S. Securities and Exchange Commission (SEC) that contain important information about companies such as financial statements, forward looking statements, risks associated with the company, etc. Every U.S. publicly traded company is required to submit regulatory filings to the SEC.

One type of regulatory filing supported in the Machine Readable Filings (MRF) product is Form 8-K. This broad form is used to notify investors in public companies of specified events that may be important to shareholders or the SEC. This is one of the most common types of forms filed with the SEC. After a significant event like bankruptcy or departure of a CEO, a public company must file a Current Report on Form 8-K within four business days to provide an update to a previously filed 10-Q or 10-K.

We have found predictive power in virtually all MRF analysis across different filing types. Please reach out to us for white papers and research on other document types and sections. For this blog we look at the predictive power of the sentiment values of the 8-K filings. Social Market Analytics’ patented NLP technology reads and assigns fine-grain sentiment scoring to the 8-K document, down to sub-section level. The analysis below demonstrates the predictive power of sentiment values from 8-K textual data. These are not trading strategies by themselves but do illustrate the predictive power of the 8-K sentiment data.

Companies publish an average of eight 8-K filings per year. For our analysis we looked at approximately 500,000 documents.

For our test:

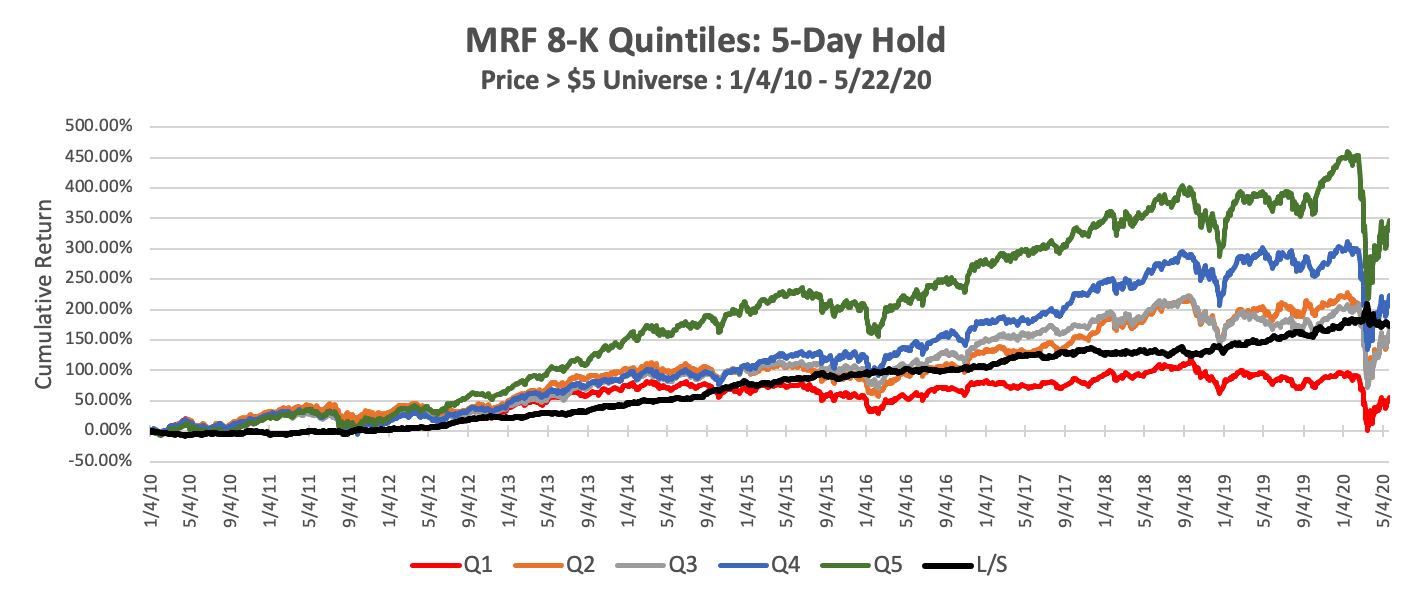

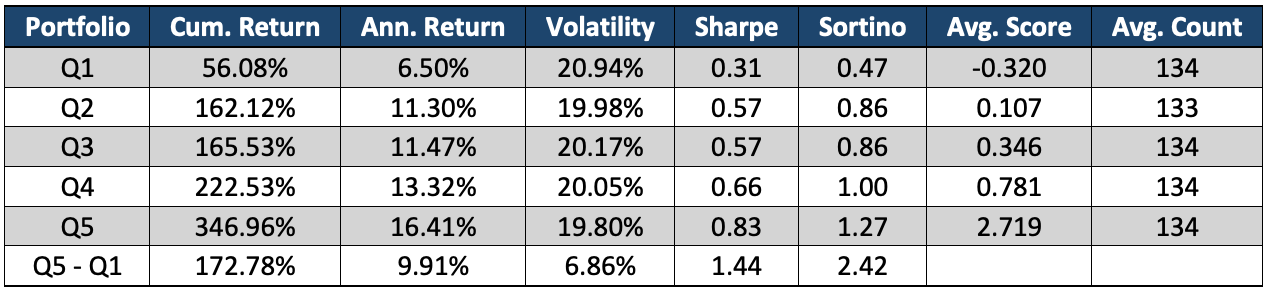

Quintiles:

Stock returns are bucketed into Quintiles daily depending on the value of Average Sentiment of the 8-K filings (Quintile 1 [Q1] has the lowest 20% of sentiment values. Quintile 5 [Q5] has the highest 20% of sentiment values). All quintiles display the Covid-19/Election/Trade War drawdown in March 2020. As you can see there is a relationship between 8-K filing sentiment and subsequent price returns. Q5 which represents the highest 20% of 8-K sentiment scores significantly outperforms all other quintiles. And we see the sentiment data is monotonic. Included is also the spread between the top and bottom quintiles (Q5 – Q1). This spread is proven significant a 99% confidence level with a T-Statistics of 4.65 and a p-value of 0.00000175.

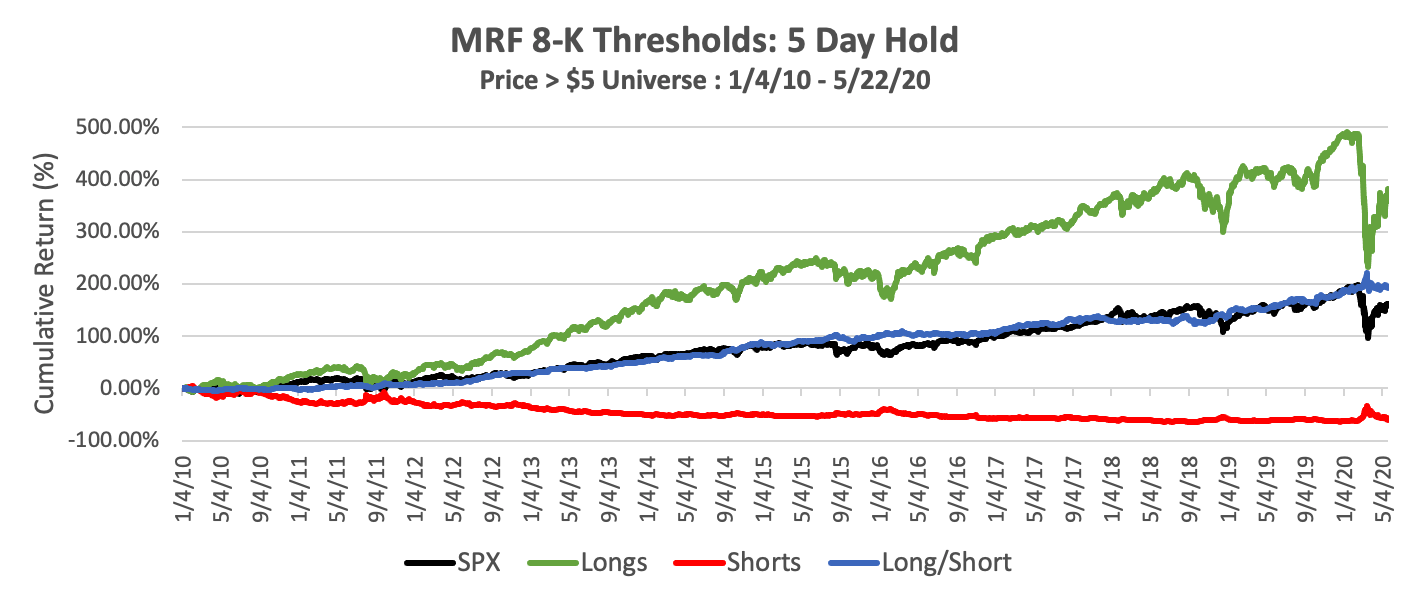

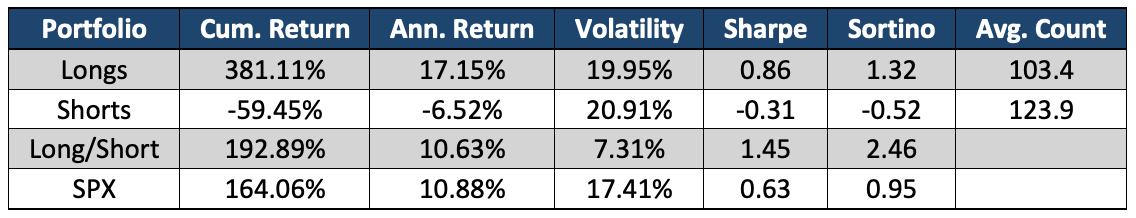

Thresholds:

In this part of the analysis, stock returns are bucketed into Long and Short buckets depending on the sentiment threshold set. In the following example, 8-K filings with an Average Sentiment greater than 1.5 are in the Long bucket and filings with an Average Sentiment less than 0 are in the short bucket. We see companies whose 8-Ks have positive sentiment greater than 1.5 go on to significantly outperform while negative ones tend to underperform. An equally weighted theoretical Long/Short portfolio generates a solid return and nice Sharpe ratio, even during the March 2020 drawdown.

Until now there has been no real way to analyze text in corporate filings. SMA’s Machine Readable Filings product allows for rapid identification of the sentiment as well as the predictive power of corporate disclosures. For more information or to start a trial ContactUs@SocialMarketAnalytics.com.